- Membership

- Certification

- Events

- Community

- About

- Help

The One Big Beautiful Bill has been signed into law, bringing with it three changes to information reporting. We had told you about these potential changes several weeks ago when the bill was still a proposal. Now, these changes are official.

$600 Reporting Threshold

The $600 threshold, so ingrained in the minds of anyone who works in accounts payable, is changing in 2026. The new threshold will be $2,000, with that threshold changing each year with inflation.

As a trivia note: the $600 threshold was put in place in 1954, and it was never adjusted for inflation. If it had been adjusted for inflation through the years, it would be approximately $7,000 today.

One item to be clear on with this change is that the $600 threshold will still apply for 2025. The change to $2,000 comes in 2026.

Form 1099-K Change

Form 1099-K reporting thresholds have fluctuated in recent years when it comes to reporting by third-party networks such as Venmo and PayPal. Reporting by these entities came about in the Affordable Care Act and set their reporting threshold at $20,000 received and 200 transactions.

The American Rescue Plan Act in 2021 changed that threshold to $600, starting in 2022. The IRS has delayed this several times, and had put into place a $2,500 threshold for 2025.

The One Big Beautiful Bill rolls the reporting requirements back to the old ACA levels of $20,000 received and 200 transactions.

This is presented mainly as an FYI, as most readers of this article probably don’t issue Form 1099-K. The rollback to the old levels is effective for 2025.

New Reporting Form

The new law calls for taxpayers to be able to deduct up to $10,000 of interest on auto loans, for interest paid on auto loans on cars where final assembly happens in the United States. To help facilitate this deduction, a new reporting form (presumably, a Form 1098) will be created, with lenders issuing this form to individuals who pay interest on auto loans during the year.

Staying Compliant at Year-End

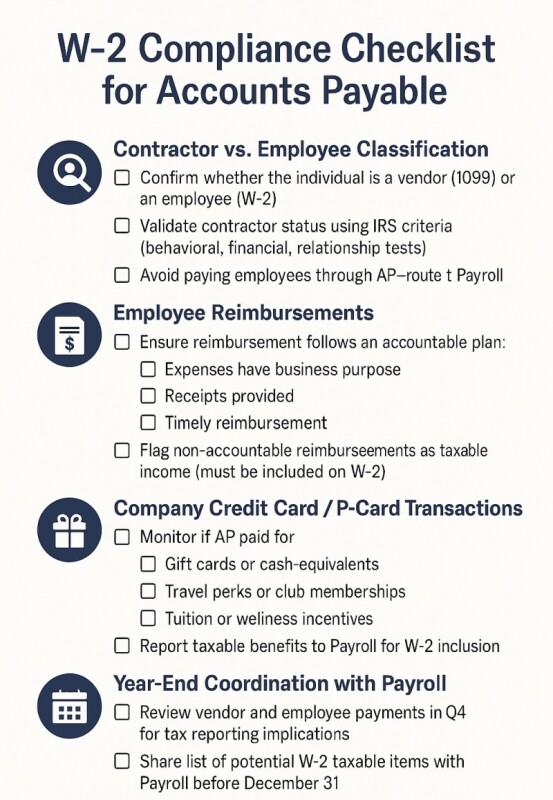

As these reporting changes take effect and year-end approaches, it’s critical for AP teams to coordinate closely with Payroll to ensure W-2 compliance. The checklist below outlines key areas to review and action before December 31.

Conclusion

The change to the $600 threshold represents a large shift in information reporting for accounts payable departments. Since the change to $2,000 takes effect in 2026, there is still time to think about your processes. As you think about this, remember that the threshold will be adjusted for inflation each year starting in 2027, so your systems will need to accommodate a different threshold each year.

Look to IOFM for more information on all of these changes.

What are you waiting for?